Bank Certificates of Deposit (CDs) with TAB Bank

Your money grows faster with our competitive rates for bank certificates of deposit.

Great Rates up to

4.10% APY

It’s your money. You’ve worked hard to make it. Now, it’s time for that money to work for you, on your own terms. Certificates of deposit from TAB Bank are available in multiple duration lengths. Whether you want to invest your money for twelve months or five years, you will find the right CDs to help you achieve your personal investment goals with TAB Bank.

Select a term for the rate information

$1000

Minimum Opening Deposit

4.10%

Annual Percentage Yield

$1000

Minimum Opening Deposit

4.05%

Annual Percentage Yield

$1000

Minimum Opening Deposit

4.00%

Annual Percentage Yield

$1000

Minimum Opening Deposit

3.80%

Annual Percentage Yield

$1000

Minimum Opening Deposit

3.75%

Annual Percentage Yield

$1000

Minimum Opening Deposit

3.75%

Annual Percentage Yield

Rates are current as of July 2, 2025.

This offer is good on new CDs only. The minimum balance to open a CD is $1,000. The annual percentage yield assumes that interest remains on deposit until maturity. A withdrawal of interest will reduce earnings. You must maintain the minimum balance indicated in the tables above to earn the disclosed APY. A penalty may be imposed for early withdrawal. Calculations of the APY assume interest is credited to the account monthly.

What is a Bank CD?

Before knowing whether or not a bank CD is right for you, you need to answer the question: What is a bank CD? Bank certificates of deposit known as “CD” for short, are issued when you invest your money for a specified length of time. The date at which your investment can be withdrawn is fixed when you open the account, and it’s known as the maturity date. You can invest in any denomination you wish above the minimum investment requirement.

When is a CD the right choice?

Knowing what your goals are is a very important piece of the puzzle when it comes to selecting the right bank account or investment account. A CD is a great choice for you if you are trying to:

- Save up for a specific event: If you are looking for an easy and secure way to store and grow a specific amount of money for a moderate amount of time, a CD is a great option for you. This could be money you have saved up for a luxury vacation, wedding, or a down payment on a new car. CDs are great because you have the power to choose the length of time you want your money to be deposited so, if your wedding is a year from now, you can set up a 12-month CD, grow your cash at a stable rate, and withdraw your money just in time for your wedding!

- Build your savings: CDs are a popular and secure way for you to build up your long-term savings! CDs typically have interest rates that are considerably higher than a standard savings account and, unlike stocks, many CDs are insured by the FDIC. This makes CDs a convenient low-risk investment strategy for savings you don’t plan to access during the given timeframe!

While CDs can serve many savings goals, they may not be the best for all situations. CDs are a fit over other financial options when you:

- Don’t need frequent or immediate access to your money: cash that is deposited into a CD account can only be accessed after the date of maturity, otherwise you may have to pay an early withdrawal fee and, in many cases, lose the interest your money had earned since the account was opened. This means that CDs are often not the best choice for an Emergency Fund or short-term savings. Instead, consider a High Yield Savings Account that will earn interest while still allowing you access to your money if you need it.

- Need access to your money within a few years (or prior to retirement): CDs are secure and the interest rate your deposit earns is typically locked during the period of time you determine at account opening. This relatively low risk means that the rates of return are often lower than what you could earn from other investment options, like stocks. If you are saving for retirement or have a long time horizon and want to earn higher returns, you might consider an IRA account or meet with a financial advisor to discuss other investment choices. However, if you have already reached retirement or know you will need access to your funds within a relatively short amount of time and want to prioritize stability over rate of return, CDs are a beneficial tool to consider.

There are many things to love about CD accounts with TAB Bank, including:

How Do Bank Certificates of Deposit Work?

What do you get when you deposit your money in TAB Bank for a specified duration? You get the security of having a fixed interest rate that will be higher than the rates offered on other accounts. Once that specific date has been reached (referred to as the maturity date), you receive your principal balance (the money you deposited) plus all the interest that has accrued. If you need to access your money before the CD matures, you must pay a penalty or lose some of the accumulated interest.

Who Issues a Certificate of Deposit?

We do! At TAB Bank, we have various options for personal certificates of deposit. You can feel confident investing your money with us because we have been in the business of helping people, like you, grow their wealth for more than 25 years.

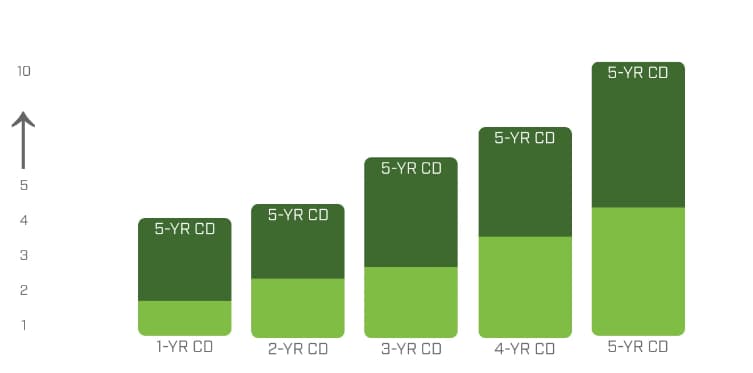

Invest Higher. Wait Longer. Gain More.

When it comes to getting the most from a personal CD account, you should always try to invest the most that you can and for the longest duration possible. That’s how it’s done if you want to reap the highest available CD interest rates. Always make wise financial decisions and invest according to your needs and budget.

Be sure you are financially stable before placing a good majority of your money in bank CDs. At TAB Bank, we extend our $1,000 minimum deposit even to longer-term, higher-interest accounts. Before you open a certificate of deposit account, secure your assets by making sure that you have an “emergency fund” available. Deposit a comfortable amount into an account that you can have immediate access to, such as a high-yield savings account.

What is the Difference Between a CD and a Savings Account?

Both a CD and a savings account will periodically pay you interest, which is added to your principal to continue earning over time. The main difference between a savings account and a certificate of deposit is that CDs are time-bound. Certificate of deposit accounts guarantee a set APY for the duration of the CD term. However, if you try to access the funds before the appointed maturity date, you may have to pay a fee or penalty, and will often sacrifice some or all of the interest earned to that point. With a savings account, you can add or withdraw money at any time but the interest rates and APY are subject to change without notice.

When you invest your money into CDs from TAB Bank, you will know the fixed interest rate of the CD before you buy it. This rate will not change for the duration of the term you select. This allows you to determine upfront what the yield will be from your investment in a certificate of deposit.

Security

Personal investing does not have to be risky. Depositing your money into a certificate of deposit is a secure way to grow your wealth.

Transparency

We are committed to helping clients understand the terms and conditions and how a bank certificate of deposit works.

Simplicity

Personal investing with TAB Bank is straightforward and easy. We are committed to streamlining the process and keeping it brief.

Build a CD Ladder to Gain the Highest Interest Accumulations

Do you know what a CD ladder is? When you divide your total investment and purchase several different CDs with a variety of maturity dates, this is known as a CD ladder. Each year when your one-year CDs mature, renew them and convert them into five-year CDs.

If you want to explore personal investing, but aren’t sure what kind of strategy would work best, consider certificates of deposit. Also, remember that breaking up the balances you want to invest and purchasing separate certificates of deposit decreases both the interest rate and the reinvestment risks.

Why Should You Invest in a CD from TAB Bank?

Click to learn more about each item

Isn't it time your money started working for you? Get started now with a CD from TAB Bank.

Roth IRA

A Roth IRA is an Individual Retirement Account to which an individual contributes after-tax dollars. Contributions may grow tax-free, and the funds may be withdrawn penalty and tax-free after the age of 59 ½, as long as the account has been opened for five years. Other advantages to a Roth IRA include:

- You may contribute at any age, as long as you have qualifying income

- There are no Required Minimum Distributions, allowing your funds to grow, even during retirement

- If you pass your Roth IRA to heirs, their withdrawals will be income tax-free

Traditional IRA

A traditional Individual Retirement Account (IRA), gives you a tax deduction on money that’s invested in your retirement fund. All the money you put into the IRA along with the investment earnings that accumulate are not taxed until they are withdrawn. After the age of 72, you must start taking distributions and will need to pay income taxes at that time.

Documentation

Roth & Traditional IRAs Available

Call 1-800-215-7128 to apply for a Traditional or Roth IRA.