Effective cash management is the lifeblood of your business. Whether you are a startup or a well-established company, cash management is how you stay in control of your business and fuel your operations. In this blog, we’ll walk you through what it is, why it matters, and how to make it work for your business.

What is Cash Management?

Think of cash management as the rhythm of your business. It keeps everything in sync, ensuring you can meet today’s needs while preparing for tomorrow’s opportunities. Essentially, cash management is how you track your money including what’s coming in, what’s going out, and what needs to be on hand to cover your day-to-day needs.

Cash inflow, or what’s coming in, can include customer payments, investments, or loans. Cash outflows, or what’s going out, are things like paying bills and payroll, purchasing inventory and paying vendors. When you manage these well, your business runs smoothly, without the worry of running out of funds and opens the door for future growth.

Key Components of Cash Management

Effective cash management is crucial for the financial health of your business. Staying in control of your cash and avoiding cash flow problems means paying attention to these three key areas.

Receivables:

This refers to managing money owed to your business by customers. Timely collection of outstanding invoices ensures a steady cash flow and less risk of delays in your operations. Effective receivables management means setting clear payment terms, sending timely invoices, following up, and making it easy for customers to pay.

Payables:

This involves managing the money your business owes to suppliers, vendors, and creditors. Properly managing payables ensures that you meet your financial obligations on time, helping to maintain strong relationships with suppliers and avoiding late payment penalties. Track when bills are due, negotiate better terms, and prioritize what gets paid first to keep your cash flow steady.

Liquidity:

Liquidity means having enough cash on hand to cover your day-to-day. This will include things such as payroll, inventory purchases, and overhead expenses. Regularly monitor your cash position and forecast what’s ahead to help maintain your business’s liquidity. This also helps avoid surprises and gives you flexibility for future growth

By staying on top of receivables, payables, and liquidity, you’ll have a stronger foundation to handle challenges and invest in growth.

Why is Cash Management Important?

Every business owner knows the anxious feeling tight margins or unexpected expenses can bring. Managing your cash flow can give you back peace of mind as well as space to plan ahead. Here’s how getting proactive with your cash can give your business more breathing room:

- Avoid Shortfalls: Make sure that your business has the funds it needs to keep operating, even during slow months.

- Build Stability: Reduce your risk of financial issues and ensure steady growth.

- Plan for the future: With a clear view of your finances, it’s easier to make confident, strategic decisions.

Key Benefits of Strong Cash Management

When your business has a solid handle on its cash flow, everything else becomes easier and a weight is lifted off your shoulders. From daily operations to long-term planning, managing your cash well creates clarity and confidence. Some more benefits of good cash management are:

- Keep Your Business Steady

Smooth cash flow means fewer crises. A well-managed cash flow ensures that your business has enough liquidity to operate without constant financial strain. - Helps Prevent Financial Crises

Effective cash management helps prevent the “feast and famine” cycle for your business, reducing the risk of cash shortages during slow months. - Clearer Decision-Making with Better Financial Visibility

With proper cash management, you’ll know where your money stands at all times, allowing for better strategic decisions. - Reduces Expensive Borrowing

When your business has strong cash management it’s less likely to rely on expensive credit or loans to cover shortfalls. - Supports Business Growth and Long-Term Planning

With a clear picture of your finances, you can invest in new opportunities when the time is right.

What is the Difference Between Cash Management and Treasury Management?

While cash management and treasury management sound like the same thing, there are some key differences. Cash management focuses primarily on your business’s daily financial operations or managing the inflow and outflow of funds to ensure that your business can meet its short-term obligations. Treasury Management, however, is broader in scope. Treasury management means overseeing all financial operations of your business, including cash management, financial risk management, and funding for long-term growth.

For businesses looking to integrate both approaches, TAB’s Business Banking Suite provides the necessary tools to manage your business’s daily needs and long-term goals.

Best Practices for Managing Business Cash Flow

- Forecast Cash Flow

Cash flow forecasting helps you know what’s coming and predict your future cash needs so you’re never caught off guard. - Automate Payables and Receivables

Automating these processes reduces manual errors and speeds up your collections, giving you more control over cash flow. Learn more about how accounts receivable financing can help streamline this. - Optimize Payment Cycles and Supplier Terms

Work with suppliers to negotiate terms that support your cash flow and forecasting to find the best payment cycles for your business. - Build an Emergency Reserve

It’s always good to have a buffer for unexpected cash flow crunches. - Leveraging Smart Business Banking Tools

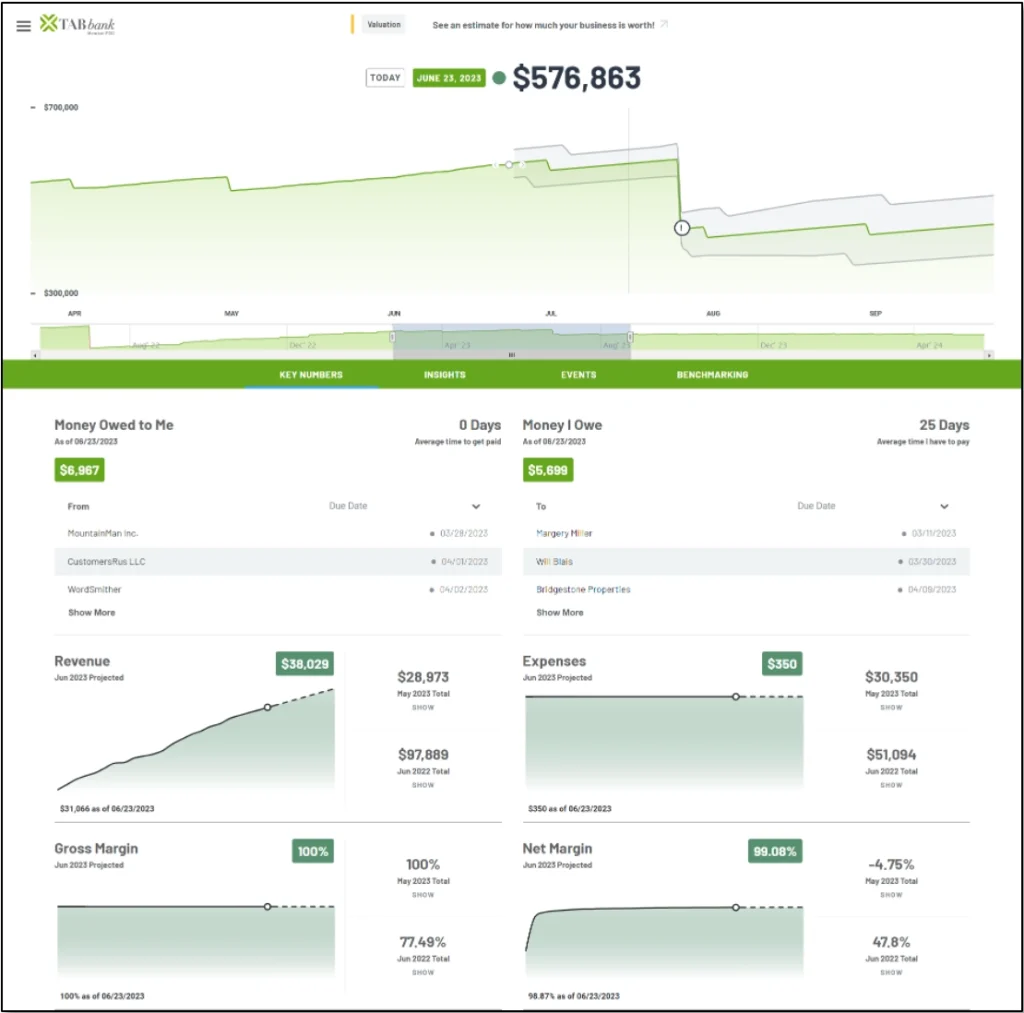

Make informed decisions about your money. Use financial management tools like TAB Bank’s Business Insights Tool to track and manage finances with real-time data on key metrics such as money owed, revenue, expenses, and net margin.

Banking Tools & Services for Cash Management

There are several tools and services that you can leverage to enhance your business’s cash management:

- Business Banking Solutions

These include cash flow management accounts, business term loans, business savings accounts, and treasury management services. - Payment Processing and Invoicing Software

Simplify and automate the payment process with the right software solutions. These tools make it easier to receive payments and track invoices. - Access to Credit Lines and Working Capital Solutions

When cash is tight, it’s crucial to have access to working capital and credit lines. Working capital financing can help ease cash flow constraints.

Partner with TAB Bank for Better Cash Management

Managing your cash well is one of the most important things you can do for your business. And you don’t have to do it alone.

At TAB Bank, we offer tailored business banking solutions that help you take control of your cash flow, plan ahead, and grow your business with confidence. Whether you’re just starting out or scaling your operations, we’re here to help.

Ready to take control of your cash flow? See how TAB’s Business Banking Solutions can support your business!