Starting your own business is a big move and setting up the right financial foundation can make all the difference. If you’ve formed an LLC (Limited Liability Company), opening a dedicated business banking account is more than just a smart step, it’s essential for protecting your assets and building long-term credibility.

Many LLC owners we work with say opening their business account was the moment their vision started to feel real. Whether you’re just getting started or laying the groundwork for growth, TAB Bank is here to support you. This step-by-step guide will walk you through how to open your LLC’s business banking account and how to make it work for your success.

Why Your LLC Needs a Business Banking Account

Opening a business banking account is about setting your business up for success. For LLC owners, this step is key to separating personal and business finances and building the financial credibility your business deserves. Here’s why it matters:

- Legal and Tax Benefits

With a business banking account you separate your personal assets from your business assets, keeping them protected. This separation strengthens your LLC’s legal protections and helps maintain the liability shield provided by your LLC structure. It also simplifies your tax filings by providing clear documentation for business expenses and income. - Business Savings Accounts/Business Money Market Accounts

Business savings and money market accounts are powerful tools that help your cash grow and build reserves. These accounts offer interest and can help you save for future business expenses. Explore TAB’s Business Savings and Money Market Accounts to find the right option for your LLC’s financial growth. - Credibility and Financial Management

Business banking gives your LLC the credibility it deserves. It shows regulating bodies and other businesses that you are a legitimate business. This makes it easier to attract customers, secure partnerships, and apply for business loans. What’s more, a business account helps you manage your cash flow efficiently and track your business’s financial performance.

Let TAB Bank simplify your financial management, so you can focus more on growing your business. Learn more about how TAB’s Business Banking Suite can help you achieve your business goals.

What You Need to Open a Business Bank Account

To make the process of opening your business account as smooth and stress-free as possible for you, it helps to know what you’ll need ahead of time. Before you begin the application, make sure you have the following documents and information ready to save you time and give you peace of mind:

- Employer Identification Number (EIN) from the IRS: This number is like a Social Security number for your business and is required for tax reporting purposes.

- Articles of Organization (LLC Formation Documents): This is the official paperwork that shows your LLC is registered with the state.

- Operating Agreement (if applicable): If your LLC has more than one member, you may need this document to outline the roles and responsibilities of each member.

- Business Licenses and Permits: These documents depend on your industry and location. Make sure you have the necessary licenses to operate legally.

- Personal Identification (e.g., Driver’s License or Passport): You’ll need to provide a valid ID to verify your identity.

Having these documents ready will ensure a smooth and efficient process when opening your business bank account.

Factors to Consider When Choosing a Business Bank Account

The business bank account you choose helps shape how smoothly your LLC runs day to day. To find the right fit for your business needs, here are a few important factors to keep in mind:

- Types of Business Accounts

Different types of accounts serve different purposes. You’ll likely need a Business Checking Account for daily transactions, but don’t forget to consider other options like Business Savings Accounts, Business Money Market Accounts, and Merchant Services for your payment processing needs. TAB Bank offers all these options. Learn more about TAB Bank’s Business Banking Suite and how it can be customized to fit your needs. - Key Features

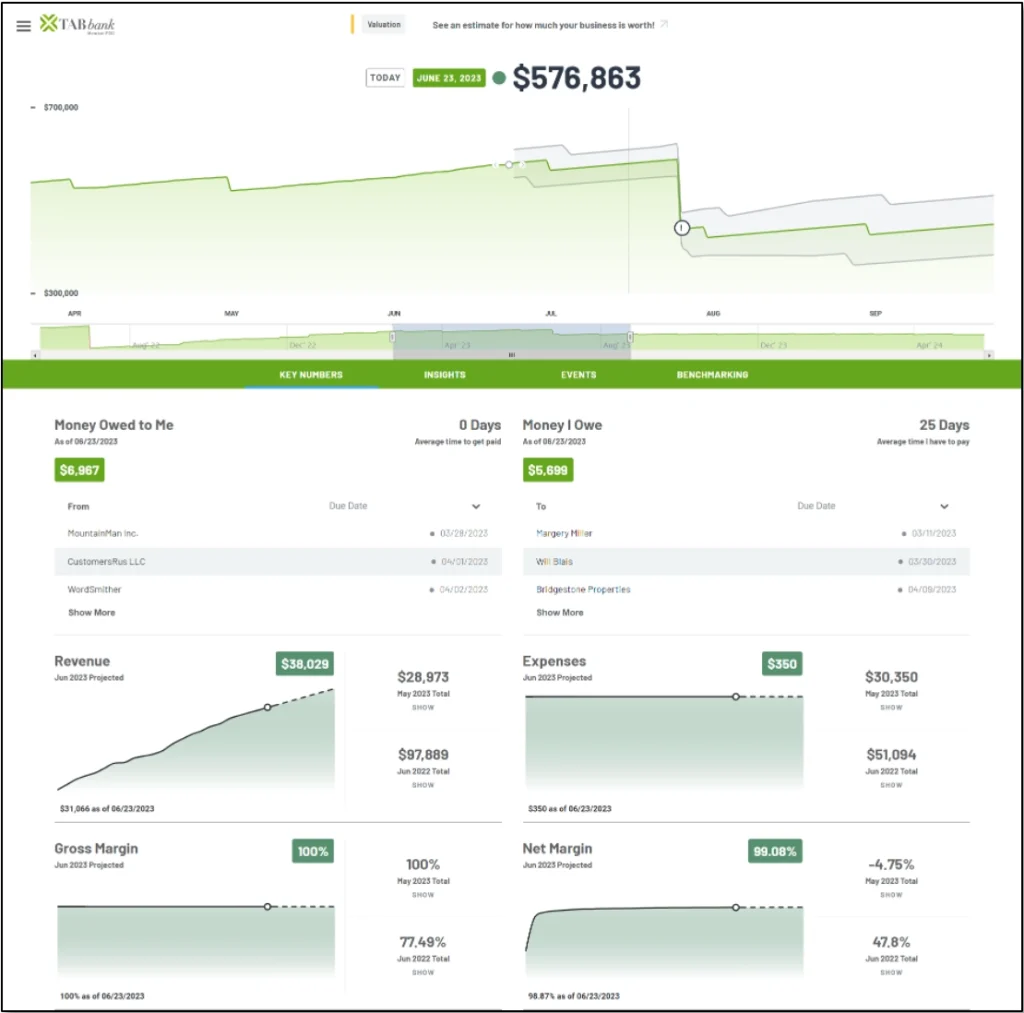

Look for accounts that offer low fees, great customer service, easy integrations with your accounting or invoicing software, and robust online banking tools. TAB Bank’s Business Insights tool helps businesses track and manage their finances by providing real-time data on key metrics such as money owed, revenue, expenses, and net margin. It also offers projections, benchmarks, and insights to help business owners make informed financial decisions and improve cash flow management. The platform provides a clear overview of current financial health and future projections, making it easier to plan and monitor business performance. - Level-Up with Treasury Management Services

As your LLC grows, so do the demands on your financial systems which is where TAB Bank’s Treasury Management Services come in. Designed to support you at every stage of growth, these tools help you streamline payments, manage cash flow more efficiently, and access deeper financial insights. It’s a smart move for businesses ready to scale with confidence.

Business Insights Tool Screenshot

Optimize Your LLC’s Business Account

Once your business account is open, it’s time to optimize it for maximum efficiency:

- Enable Online and Mobile Banking

Take advantage of online and mobile banking features to stay on top of your business’s finances. TAB Bank offers simple, user-friendly tools to monitor your accounts and manage your business anywhere, anytime. - Order Business Debit Cards and Checks

Business debit cards and checks are essential for managing expenses and making payments. You can easily order them through TAB Bank as part of your account setup. - TAB’s Card Hub

With the “My Cards” hub in TAB Online & Mobile banking, you can enjoy greater control over your business debit cards. You can set spending limits, monitor transactions, and receive instant alerts. This helps you keep track of business expenses in real-time. - Easy Account Setup with TAB

Setting up your business account with TAB Bank is quick and straightforward. Learn more about how TAB makes banking simple with our Business Banking Suite.

Client Success Story

TAB Bank’s commitment to reliability and understanding of its clients’ unique needs has been a driving force behind the success of many businesses. One standout example is Everee, an innovative payroll company that offers businesses the ability to pay workers every day. According to Tyler Ploeger, Co-Founder and CFO of Everee:

“TAB Bank is more than a partner — they’re a key to our success.”

Everee relies on TAB Bank’s transaction processing capabilities, managing millions of payments each month. Their collaboration with TAB Bank has not only provided the necessary support for scaling operations but has also been instrumental in disrupting traditional payroll systems.

Start Your LLC on the Right Financial Footing

Opening a business banking account is the first step toward building a strong financial foundation for your LLC. Whether you’re launching your first venture or expanding an established business, TAB Bank offers tailored solutions designed to support your growth every step of the way.

Ready to move forward with confidence? Explore TAB Bank’s Business Banking Solutions and find the right fit for your business’s future.