-

Non-Recourse Factoring: Is It Right For Your Business?

For small business owners, managing cash flow effectively is a critical aspect of financial health. One financial tool that can help maintain liquidity and manage receivables is factoring. Factoring is a financial service that can transform your business dynamics and increase capital on hand. If you have been considering factoring, you’ve probably seen the terms…

-

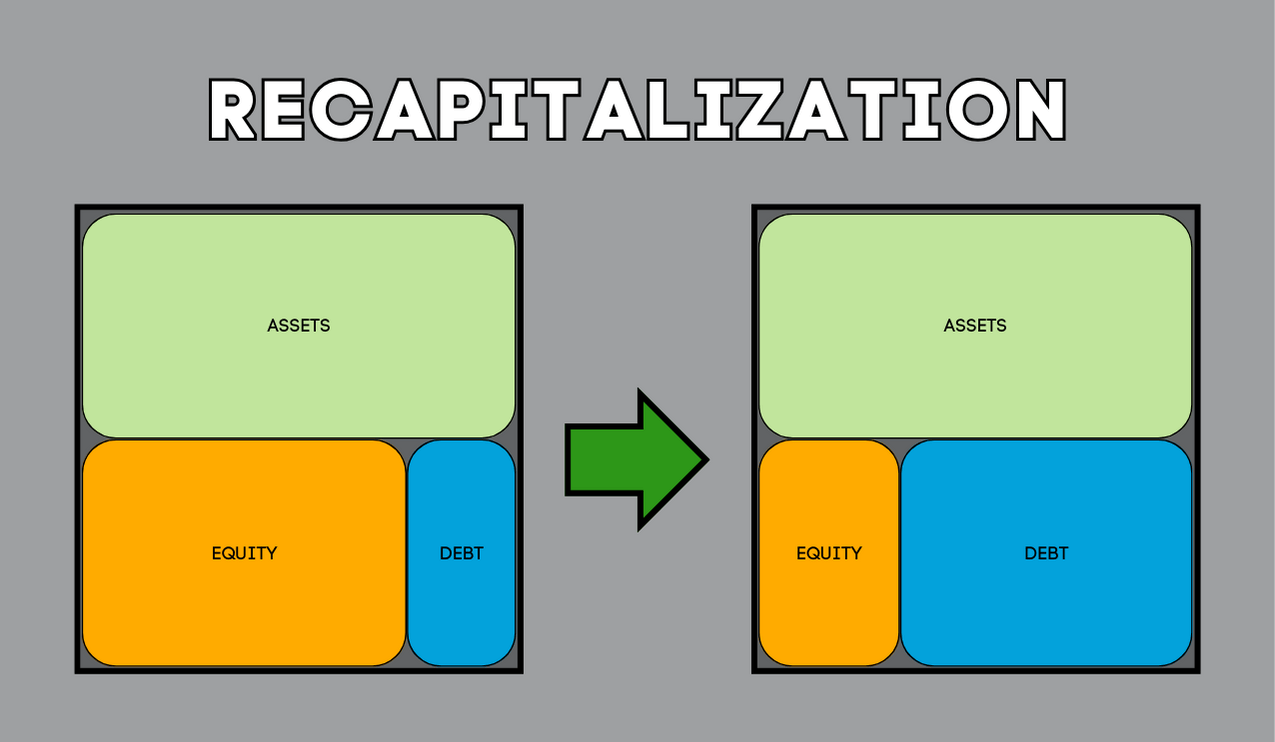

What is Recapitalization?

Recapitalization is when companies shift their debt-to-equity ratio. Reasons behind the shift vary depending on company size, performance, and goals.

-

Accounts Receivable Financing vs Factoring

Financing is using invoices as collateral, factoring involves the purchase of your invoices. Learn more with TAB Bank.

-

What is Working Capital Financing?

Working capital financing can help a business with low liquidity make payments on its day-to-day expenses and maintain operations.

-

What is Working Capital Management? Definition, Elements, & Ratios

Working capital management is the process of forecasting current assets and liabilities to ensure working capital needs are met.

Search the website

Popular Categories

- Accounts Receivable Financing (13)

- Asset-based Lending (12)

- Blog (130)

- C-Suite (4)

- Employment/Career (4)

- Entrepreneur (1)

- Factoring (10)

- Financing (19)

- Financing Options (23)

- Fleet Management (11)

- Fuel Prices (2)

- General Business Tips (32)

- General Trucking News (7)

- Leadership (2)

- Legacy, Blog Source (6)

- Legacy, Home (15)

- Legacy, Press Releases Source (2)

- Marketing (2)

- Paycheck Protection Program (PPP) (3)

- Payments (2)

- Personal Banking Tips (20)

- Press Releases (140)

- Raising Capital (14)

- Safety (4)

- Sales (3)

- TAB Bank in the News (11)

- Trucking (20)

- Trucking Equipment (10)

- Uncategorized (12)